Key Takeaways

- Bitcoin has gained nearly 1,650 points in market value since Monday’s open.

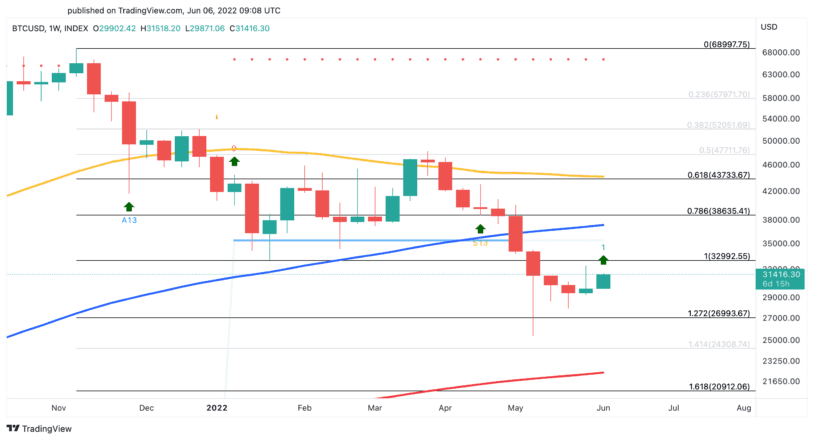

- The TD Sequential indicator shows a buy signal on BTC’s weekly chart.

- A sustained close above $33,000 could result in an upswing to $38,600.

Bitcoin appears to be gaining steam for a significant rebound. Still, the pioneer cryptocurrency has yet to overcome a significant resistance zone.

Bitcoin Aims to Breach Resistance

Bitcoin kicked off Monday on a positive note after closing its first green weekly candlestick in ten weeks.

The flagship cryptocurrency has gained nearly 1,650 points in market value over the last few hours. The sudden spike in volatility pushed Bitcoin to a high of $31,500. Further buying pressure is expected if BTC can overcome one final area of resistance.

The Tom DeMark (TD) Sequential indicator suggests that Bitcoin could have the momentum to advance higher. It presented a buy signal on the weekly chart in the form of a red nine candlestick. The bullish formation is indicative of a one to four weekly candlestick upswing.

Bitcoin would have to slice through the $33,000 level to validate this optimistic outlook. By doing so, it could encourage sidelined investors to re-enter the market, pushing BTC to its next level of resistance at around $38,600.

Reduced BTC Supply

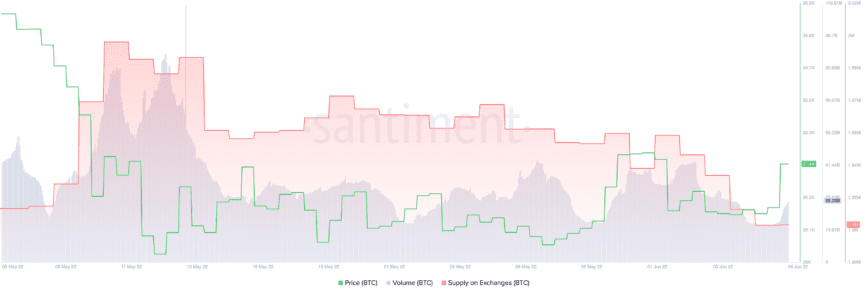

Interestingly, the supply of Bitcoin on trading platforms has dramatically decreased over the past week. On-chain data from Santiment shows that roughly 50,000 BTC, worth $1.5 billion, were withdrawn from known cryptocurrency exchange wallets since May 30.

The notable decline in Bitcoin’s balance on exchanges suggests that there are fewer tokens available to sell, which could also be a positive sign for short-term price action.

Watch If BTC Price Surpasses $33,000

Still, Bitcoin’s bullish thesis can only be validated if it turns $33,000 into support. Failing to do so could generate more fear in the market and trigger another sell-off. If this were to happen and BTC suffers a weekly close below $27,000, the next area of interest may sit much further down at around $21,000.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Celrbug.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by, or in connection with, the use of or reliance on any content, goods or services mentioned in this article.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Celrbug.com makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Celrbug.com is not an investment advisor. We do not give personalized investment other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.