So you jumped on board the Bitcoin train and now its that time of year; tax filing time. You probably do not have any idea of what you should report and how to calculate the taxes resulting from trading in cryptocurrencies. Here’s what you need to know.

For Canadian citizens who cashed out any of their crypto assets over 2021, the time to start preparing for crypto taxes is fast approaching. Tax returns can be filed as early as Feb. 28 all the way up to the filing deadline of April 30.

While the filing process is generally quite straightforward for things like traditional employment, it gets much trickier when cryptocurrencies are involved – and yes, you are required to pay taxes on crypto in Canada.

The Senate reviewed crypto tax information in 2014 and recommended Canada’s leading body for taxes, the Canada Revenue Agency (CRA) issue guidance on how this new form of currency should be treated in the country.

When do Canada citizens have to pay crypto taxes?

Under the guidance produced by the CRA, taxable events occur upon the disposition of any cryptocurrency. Disposition is the CRA’s term for “giving, selling or transferring” something, which in this case is a crypto asset. In general, common crypto dispositions that would be considered as taxable events include:

- Paying for goods and services using cryptocurrency.

- Selling crypto assets

- Trading one cryptocurrency for another (including swaps, exchanges and peer-to-peer trades)

- Cashing out cryptocurrencies into fiat currency

- Gifting crypto assets to friends, family or work colleagues

This definition only views crypto transactions as taxable events, and there are no tax requirements for simply holding crypto. In short, the Income Tax Act holds that any bartered transactions, like the disposition of cryptocurrencies, will have income tax implications.

The CRA treats cryptocurrency as a commodity under the Income Tax Act. Under this definition, crypto transactions can be treated as either business income or capital gain, depending on the type of transaction.

Business Income

Taxable business income is crypto income earned as part of a business operation. Determining whether income is business income is determined on a case-to-case basis. However, some common signs of business income include:

- Promoting a product or service

- Commercial activities that are done in a “viable way”

- Intent to make a profit, irrespective of whether you’ll likely to do so in the near future or not.

- Acting like a business, such as preparing a business plan and acquiring inventory.

Although business activities can be seen as regularly occurring, sometimes a single transaction can constitute business income. Because it’s a case-by-case basis, the CRA will typically look at the “adventure or concern in the nature of the trade.” While this sounds complex in practice, it can actually be more straightforward. In determining whether you are acting as a cryptocurrency business, the CRA has provided further guidance on specific transactions and some common examples of crypto businesses including:

- Running a cryptocurrency exchange

- Crypto mining operations

Capital gains

If the disposition of a cryptocurrency does not constitute business income and it sells for more than the purchase price, then the CRA considers the taxpayer to have realized a capital gain. Capital gains are considered income for your tax year, but only half of realized capital gains are subject to the capital gains tax (“taxable capital gains”).

How much crypto tax do you pay in Canada?

Capital gains

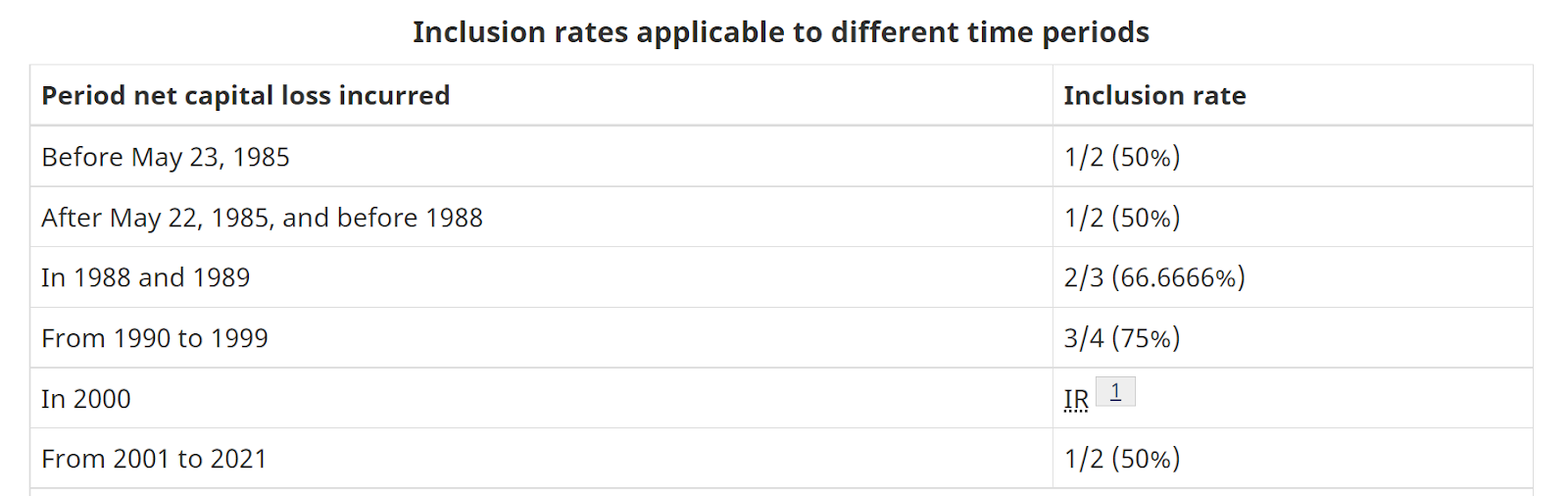

Your capital gains taxes are determined by what is called the inclusion rate (IR), which is made up of taxable capital gains and allowable capital losses. IR has changed on multiple occasions but is currently at 50% of your total IR (taxable capital gains – allowable capital losses).

Business Income

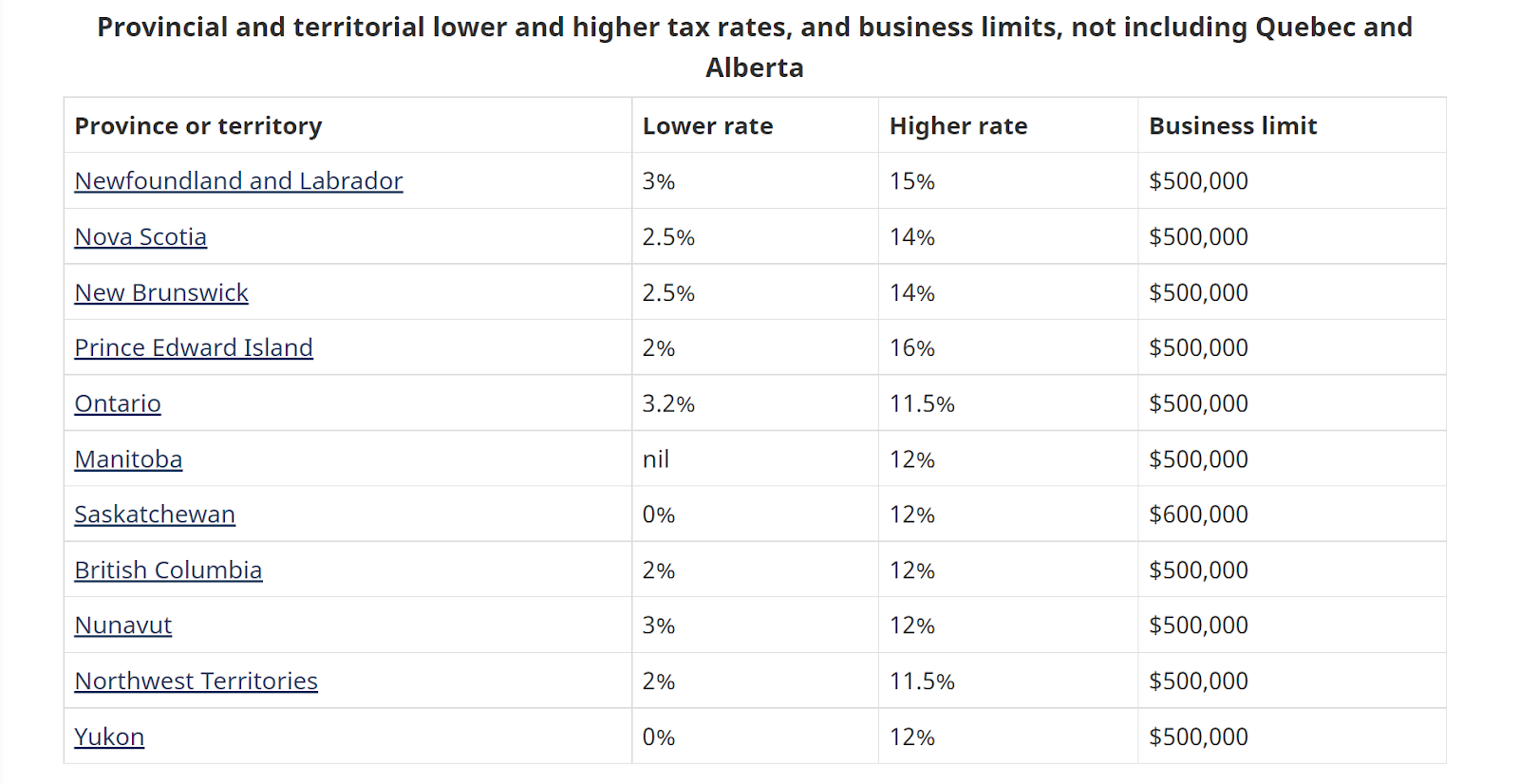

Generally, different provinces in Canada will have different rates for income tax. Lower rates are typically reserved for income eligible for the federal small business deduction. While provinces can typically set whatever the maximum business limit is for this income, most use the federal business limit as a guide. Any business income above the business limit is required to pay the higher rate. The rate table is as follows:

via this site