Highlights

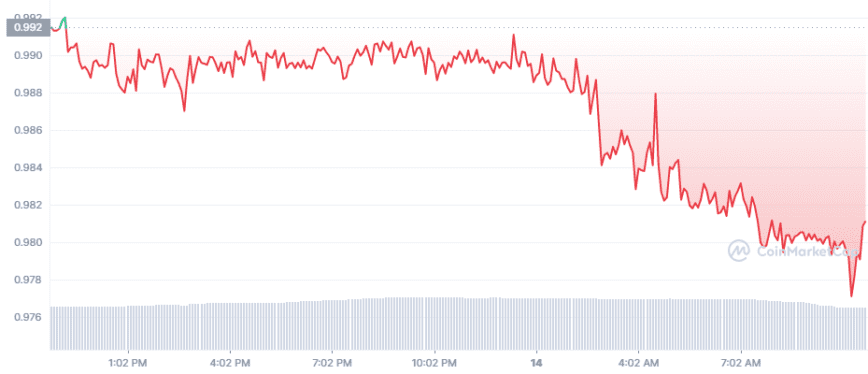

- USDD lost its dollar peg Monday amid a broader crypto market decline.

- The TRON DAO Reserve, an organization set up to ensure USDD trades at dollar parity, has deployed $2 billion to help defend the USDD peg.

- However, more than 24 hours after deploying the capital, USDD has still not been able to regain its peg.

TRON’s USDD algorithmic stablecoin has been trading under its dollar peg for more than 24 hours.

USDD Drops Below Peg

Just 40 days after launching, USDD is fighting for its life.

The algorithmically-backed stablecoin lost its dollar peg Monday as the crypto total market cap plunged below $1 trillion for the first time since January 2021. In response to the depeg, the TRON DAO Reserve, an organization set up to ensure USDD trades at dollar parity, has deployed $2 billion to restore the USDD peg.

“Funding rate of shorting #TRX on @binance is negative 500% APR. @trondaoreserve will deploy 2 billion USD to fight them. I don’t think they can last for even 24 hours. Short squeeze is coming,” tweeted TRON founder Justin Sun Monday morning. At the time, USDD had dipped slightly below a dollar, trading at around $0.98. More than 24 hours and $2 billion later, it has still not been able to regain its peg.

TRON DAO Reserve Deploying Assets To Regain Peg

USDD uses an algorithmic mechanism to maintain a stable dollar value. When the stablecoin trades under $1, arbitrageurs can burn it for $1 worth of TRON’s native cryptocurrency, TRX. Conversely, when USDD trades above $1, arbitrageurs can swap $1 worth of TRX for one USDD, minting more USDD in the process and increasing its supply. It is worth noting that USDD’s algorithmic mechanism closely resembles that of TerraUSD, the failed stablecoin that entered a death spiral when it lost its dollar peg at the beginning of May, wiping out over $40 billion of value.

As arbitrageurs attempt to profit by swapping 1 USDD for $1 worth of TRX, it creates immense selling pressure on the TRX token. Since USDD started losing its peg, TRX has dropped 16.7%. As Sun noted in his tweet, the TRX funding rate on crypto exchange Binance is negative 500% APR, meaning that many traders have opened short positions on the token to profit from a potential further decline in value.

By deploying $2 billion, the TRON DAO Reserve likely plans to buy huge amounts of TRX in an attempt to create a “short squeeze,” forcing those short on TRX to buy back the underlying TRX tokens and ultimately giving arbitrageurs more runway to restore the USDD peg. However, this strategy is incredibly risky. If there is more money placing bets on the short side than the TRON DAO Reserve has on hand to buy up TRX, the token could continue to fall.

If the price of TRX cannot be stabilized, the TRON DAO Reserve will need to deploy more reserve assets to help maintain USDD’s dollar peg. Currently, the DAO holds $10.8 billion TRX, 14,040 BTC, 140,000,000 USDT, and 500,000,000 USDC in reserve, providing a collateralization ratio of around 248% for the 723,321,764 USDD in circulation.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Celrbug.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by, or in connection with, the use of or reliance on any content, goods or services mentioned in this article.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Celrbug.com makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Celrbug.com is not an investment advisor. We do not give personalized investment other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.