BTC, ETH Price Summary March – April 2022

- Bitcoin has dropped by nearly 13% since Mar. 28.

- Likewise, Ethereum has incurred more than 12% in losses.

- Both tokens are now approaching key support areas that may contain the bleeding.

Bitcoin and Ethereum are struggling to find support, while traders in the futures markets are showing signs of optimism. Such market behavior could result in a brief upswing before another retrace.

DeMark Indicator – Buy Bitcoin

Bitcoin appears to be gaining momentum for a rebound after the steep correction it has endured over the past two weeks.

The top crypto suffered a significant downturn after reaching a high of $48,000 on Mar. 28. Its price dropped by nearly 13%, losing more than 6,000 points in market value. Despite the significant losses incurred, it appears that market participants are still optimistic.

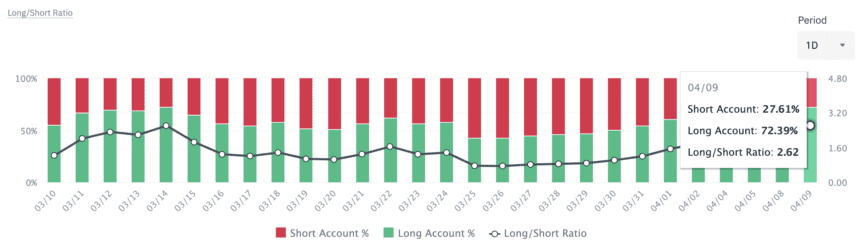

On Binance Futures, the BTCUSDT Long/Short Ratio has continued to surge, hitting a 2.62 ratio on Apr. 9. Roughly 72.4% of all accounts on the world’s largest crypto derivatives exchange by trading volume are net-long on Bitcoin.

Although Bitcoin does not tend to follow the herd, the bulls could be proven right this time around.

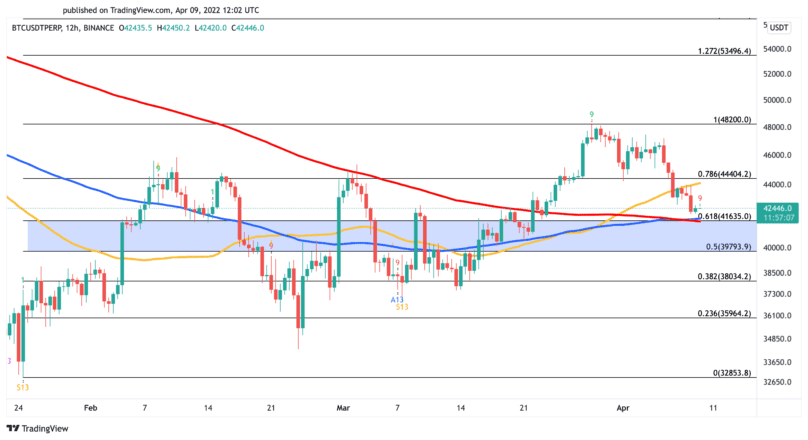

The Tom DeMark (TD) Sequential currently presents a buy signal on Bitcoin’s 12-hour chart. The bullish formation developed in the form of a red nine candlestick, which is indicative of a one to four candlesticks upswing.

A spike in buying pressure could help validate the optimistic outlook and push Bitcoin toward the $44,400 resistance level. A decisive 12-hour candlestick close above this hurdle could result in a more significant upswing to retest the recent high of $48,200.

However, while the odds appear to favor the bulls, Bitcoin could still extend its losses before it rebounds. The most significant foothold underneath Bitcoin lies between $41,600 and $40,000. If this support area is breached, it may trigger a liquidations cascade, sending prices to $38,000 or even $36,000.

Ethereum’s The Merge News Not Affecting Price As Expected

Ethereum is consolidating within a $140 price range without providing a clear signal of its next move.

The second-largest cryptocurrency by market cap has been stuck between $3,300 and $3,160 over the last three days after suffering a 12.27% correction. This price pocket does not appear to be attracting sidelined investors despite the significance of Ethereum’s upcoming plans. Though the launch date is still unknown, Ethereum is currently preparing to complete “the Merge” from a Proof-of-Work to a Proof-of-Stake consensus mechanism, something the blockchain’s fans have been anticipating for several years. It’s expected to ship sometime in 2022.

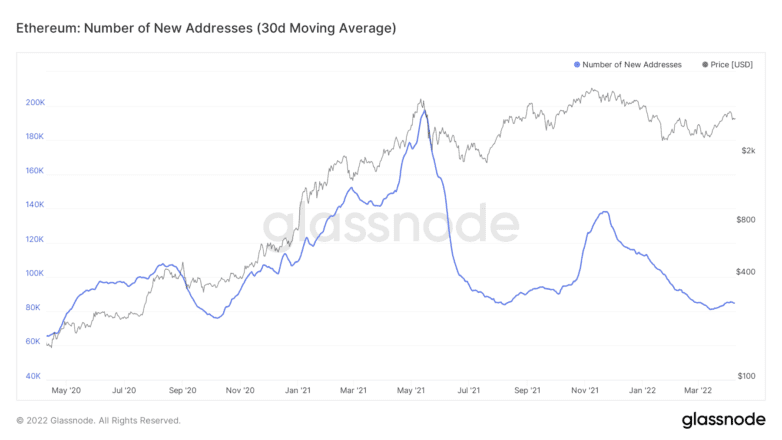

The network’s current expansion rate reflects the lack of interest. The number of new daily addresses created on the Ethereum blockchain has remained stagnant at an average of 85,000 addresses over the past month. A sustained uptrend on this on-chain metric could lead to further upward price action as it would signal the entrance of retail investors.

Until that happens, transaction history shows critical supply and demand areas to watch out for.

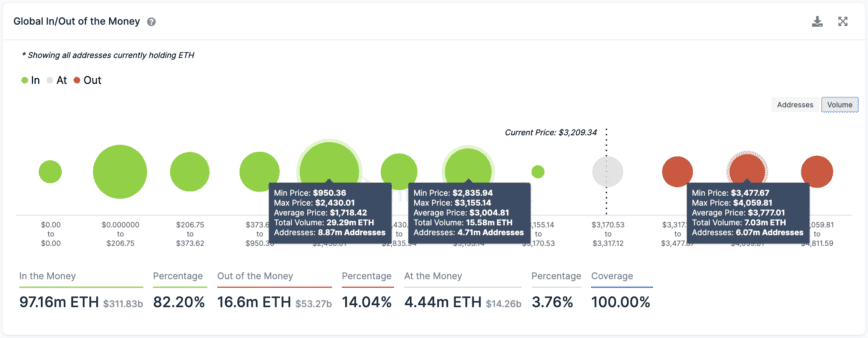

IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals that the most significant support level for Ethereum sits at an average price of $3,000, where 4.71 million addresses are holding 15.58 million ETH. Meanwhile, the most significant resistance zone is $3,780, where 6.07 million addresses have previously purchased over 7 million ETH.

Ethereum needs to break through support or resistance to resolve its ambiguity. Slicing through the $3,000 demand zone could see ETH drop toward $2,400. However, if the bulls break past the $3,780 supply wall, prices could advance toward $4,600.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Celrbug.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by, or in connection with, the use of or reliance on any content, goods or services mentioned in this article.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Celrbug.com makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Celrbug.com is not an investment advisor. We do not give personalized investment other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.