Institutional Crypto Adoption Impact on Bitcoin Price

The head of a major American hedge fund thinks the crashes and pumps of Bitcoin (BTC) will be less volatile going forward.

In a new blog post, Pantera Capital CEO Dan Morehead says more institutional ownership of BTC and a higher Bitcoin market value will moderate the top crypto asset’s price swings.

“While we’ve had two -80% bear markets already, I believe those are a thing of our primordial past. Future bear markets will be shallower. The previous two have been -61% and -54%.

Unfortunately, there’s no free lunch. The flipside is we probably won’t see the 100x rallies anymore either.”

Morehead argues that the current bear market is finished and Bitcoin has moved on to a new rally cycle.

“The next 6-12 months are likely to see a massive rally as investors flee stock, bond, and real estate markets – for blockchain.”

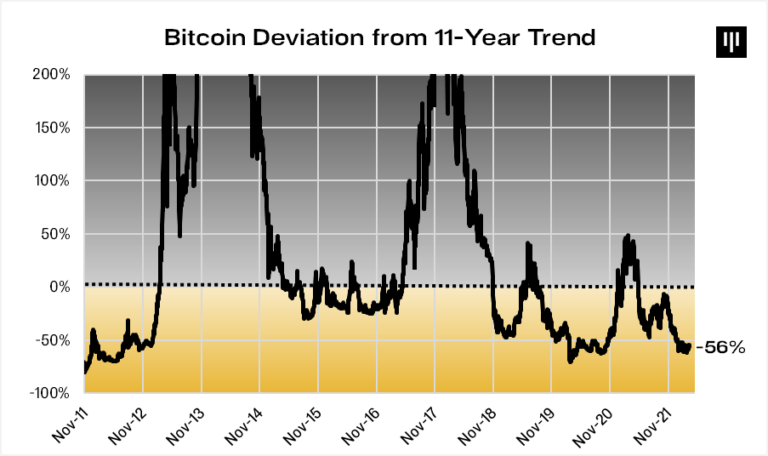

The CEO also notes that BTC in early April was 56% below the 11-year exponential growth trend, which he says is a “rare” level of cheapness for the Bitcoin market.

Bitcoin is trading at $41,341 at time of writing. BTC is up more than 4% in the past 24 hours but down more than 4% from where it was priced a week ago.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Celrbug.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by, or in connection with, the use of or reliance on any content, goods or services mentioned in this article.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Celrbug.com makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Celrbug.com is not an investment advisor. We do not give personalized investment other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Featured Image: Shutterstock/RomanYa/Sensvector